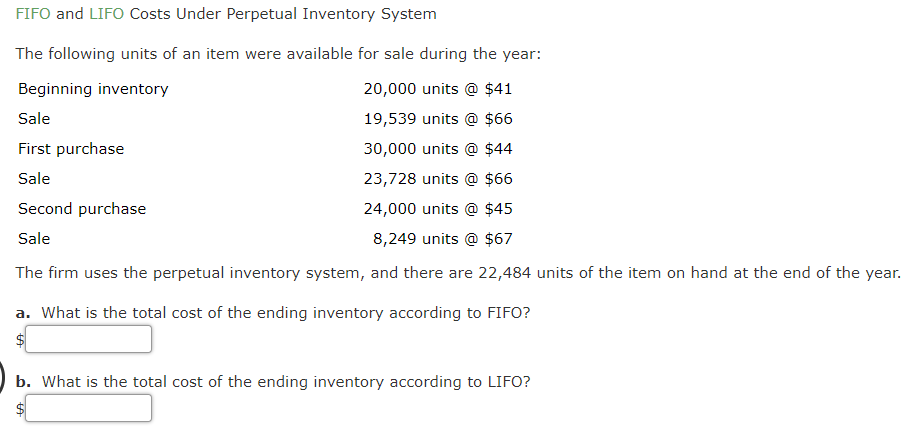

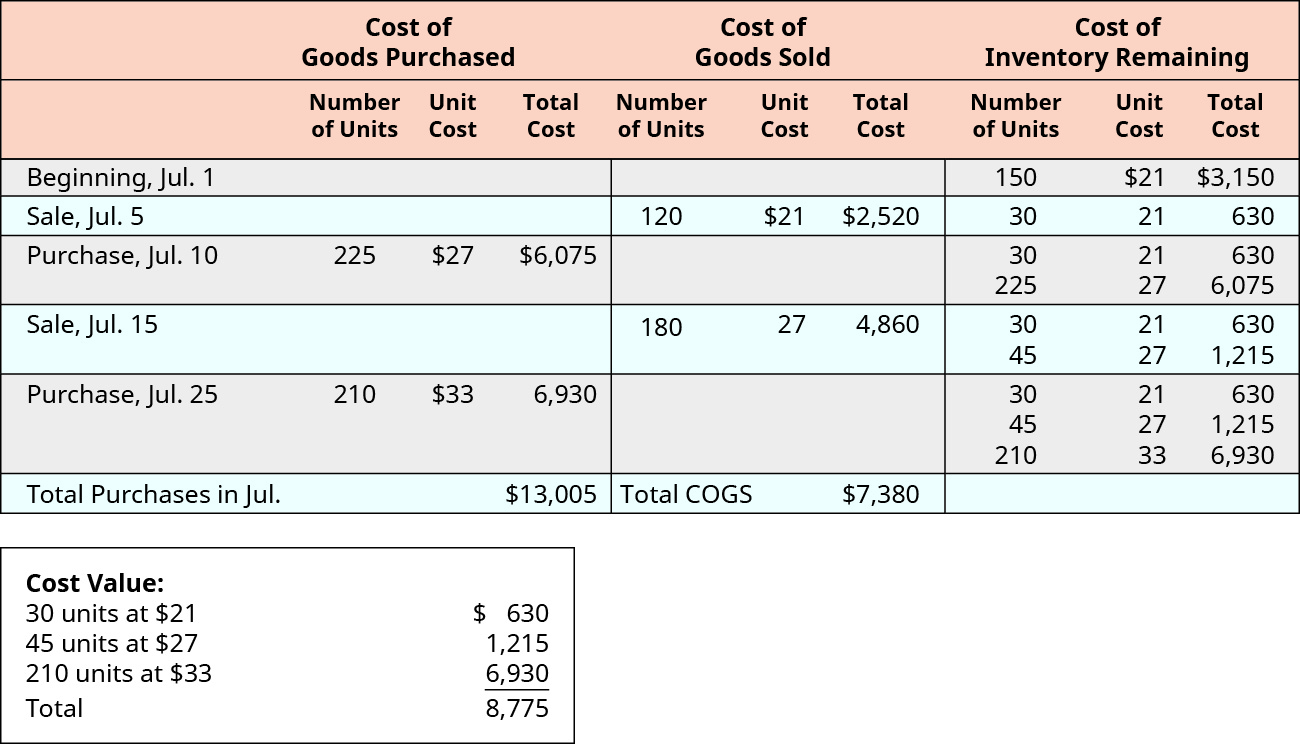

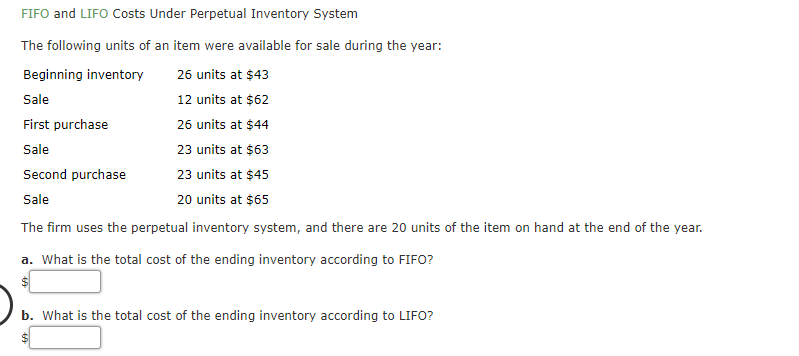

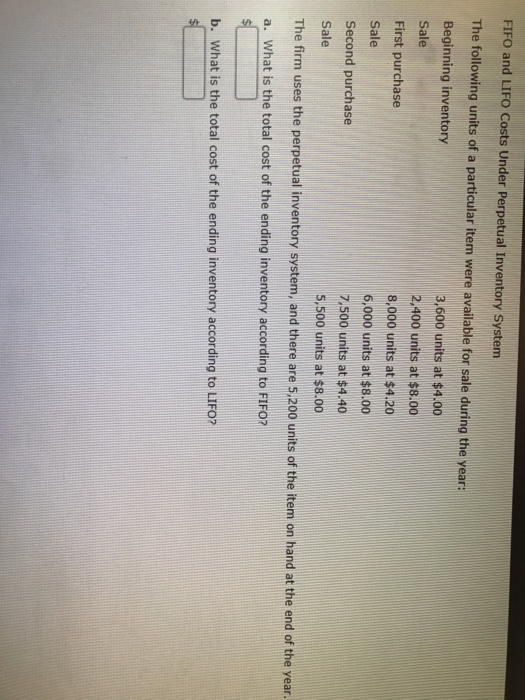

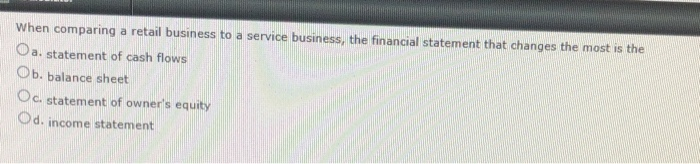

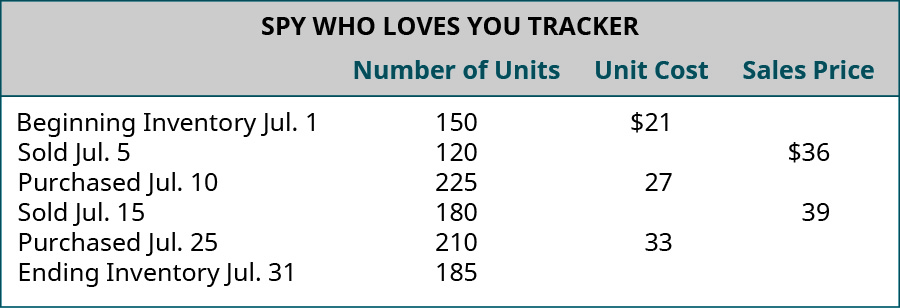

Fifo And Lifo Costs Under Perpetual Inventory System

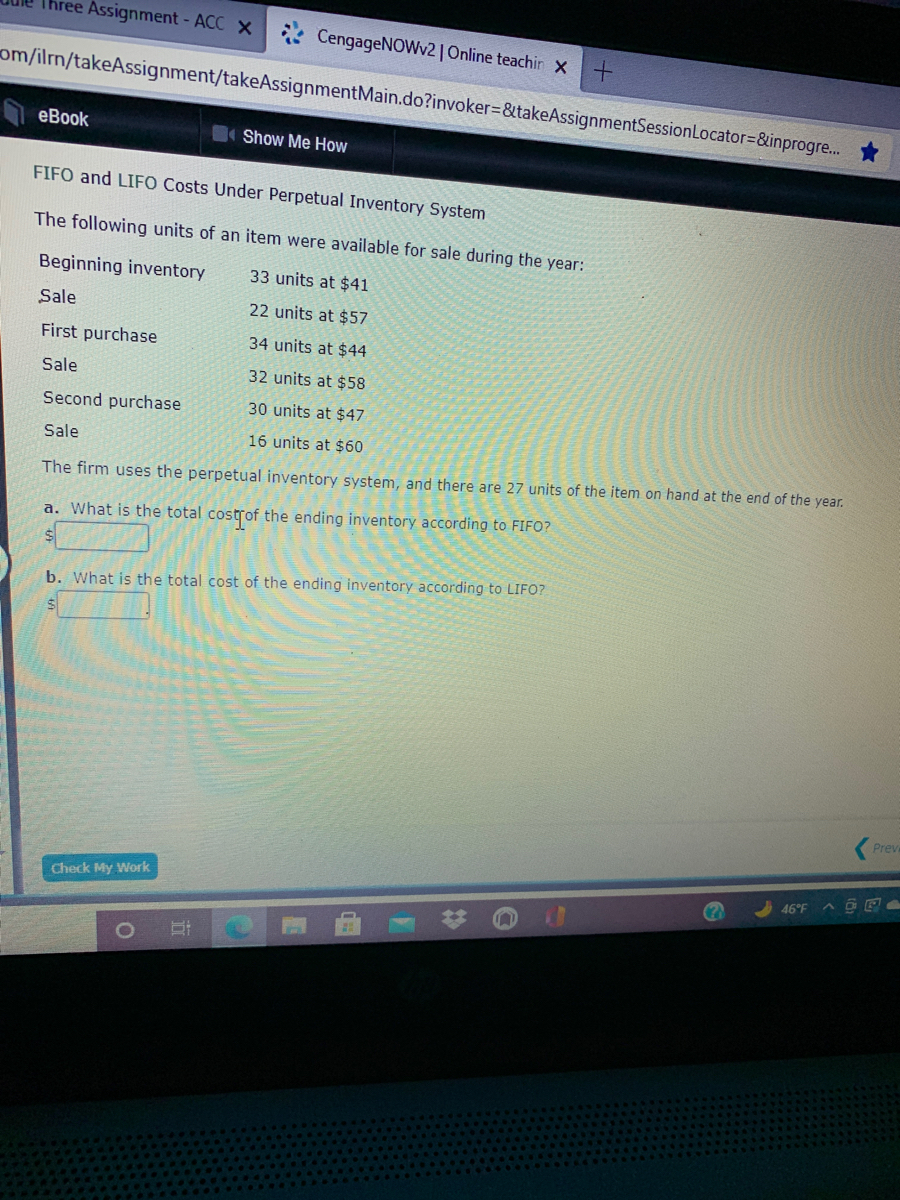

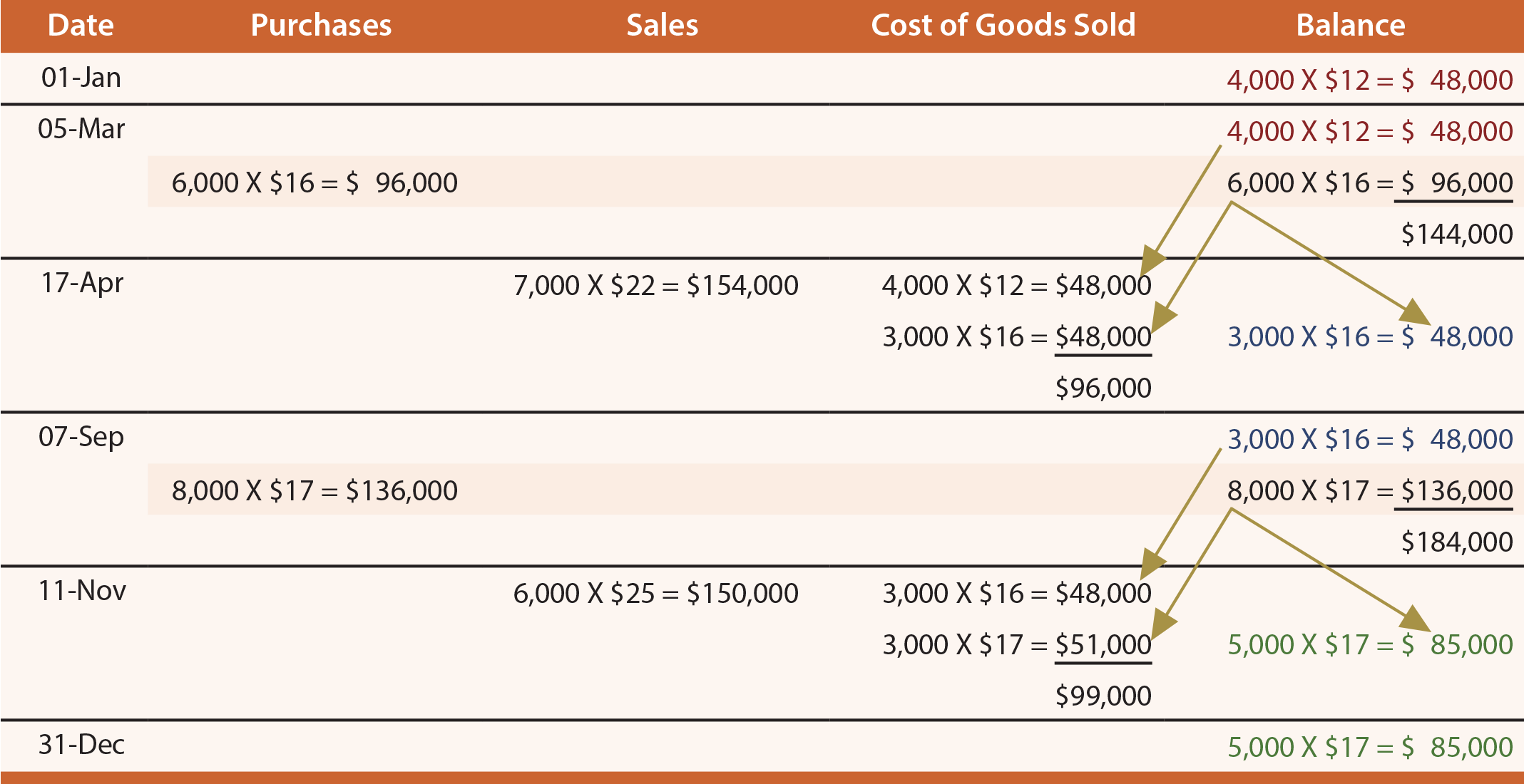

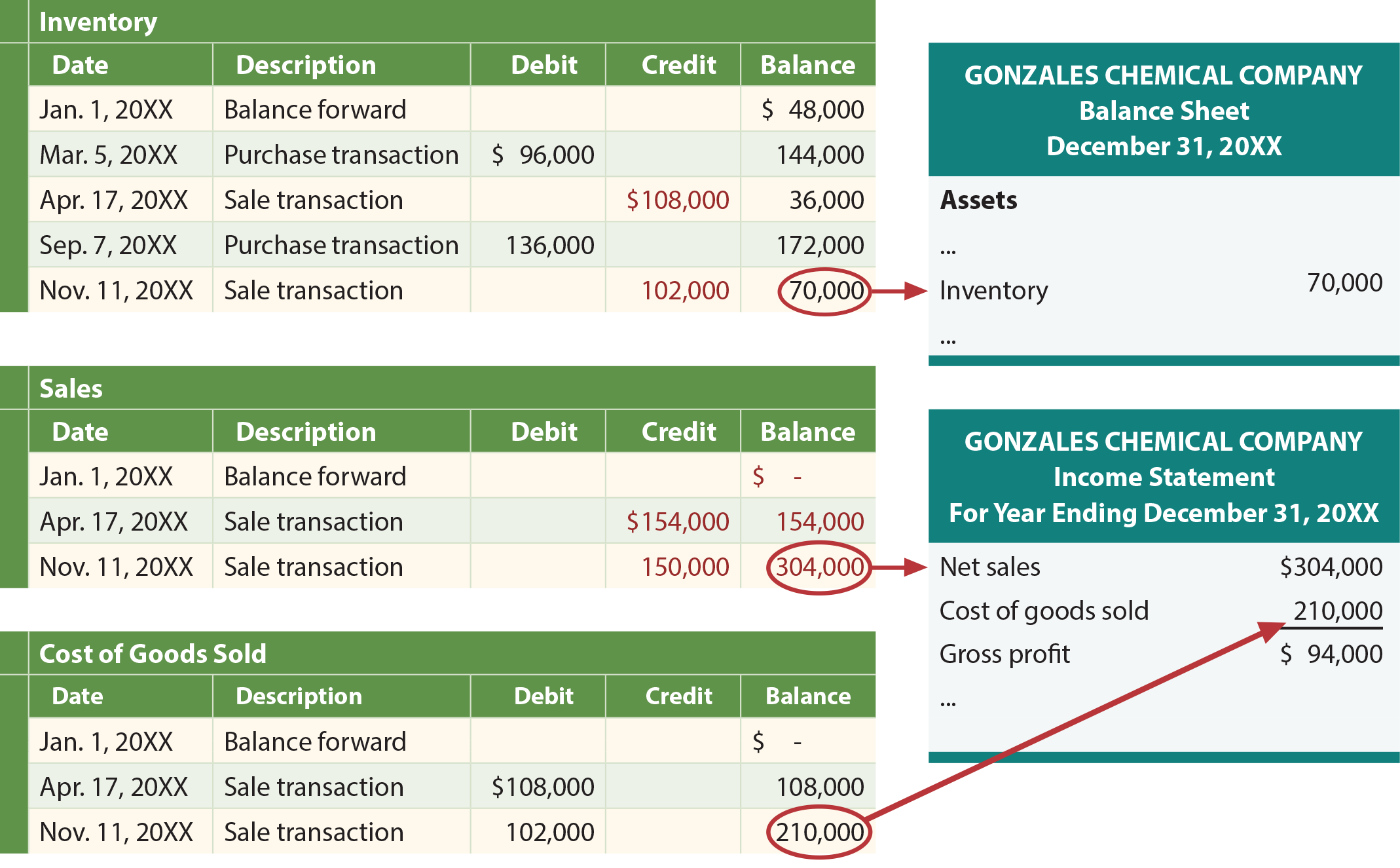

Fifo and lifo costs under perpetual inventory system. Compute the cost of goods sold and the cost of inventory in hand at the end of the month of January 2012. Perpetual inventory system updates inventory accounts after each purchase or sale. Sales-related purchase related transactions FIFO LIFO costs under perpetual system Periodic Inventory by methods see rest of problem for full.

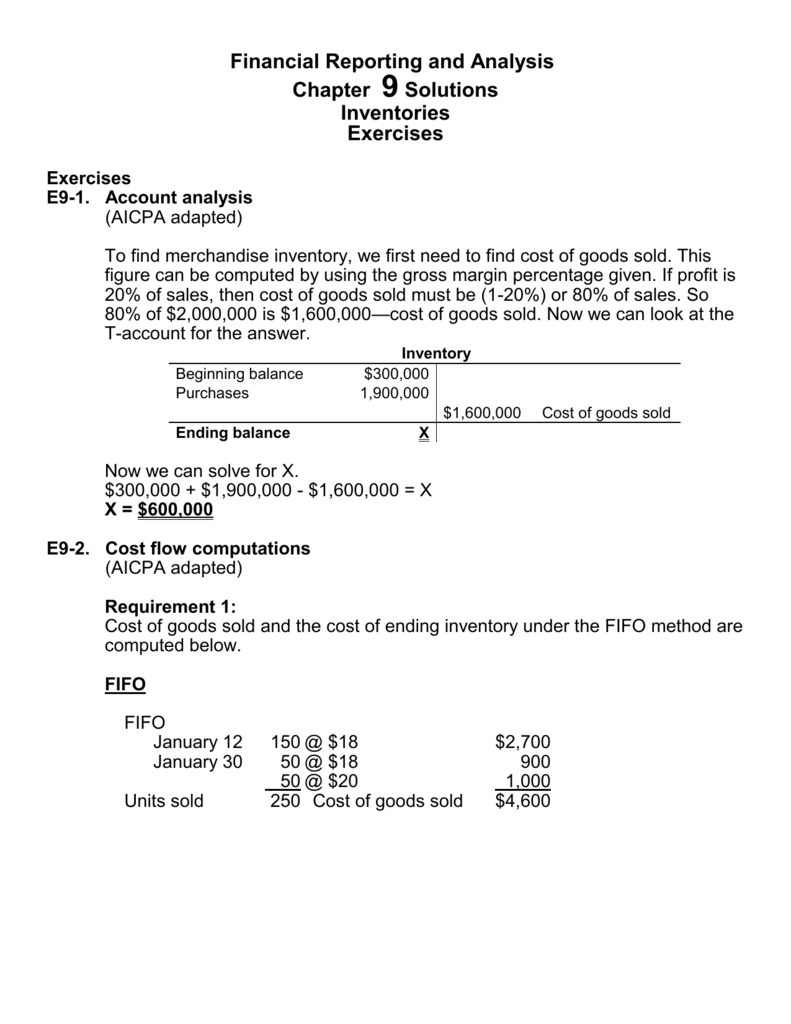

FIFO valuation under periodic inventory system Cost of goods sold 11000 Cost of ending inventory 8600. Its nice thanks alot me learn form it very much. Prepare journal entries to record the above transactions under perpetual inventory system.

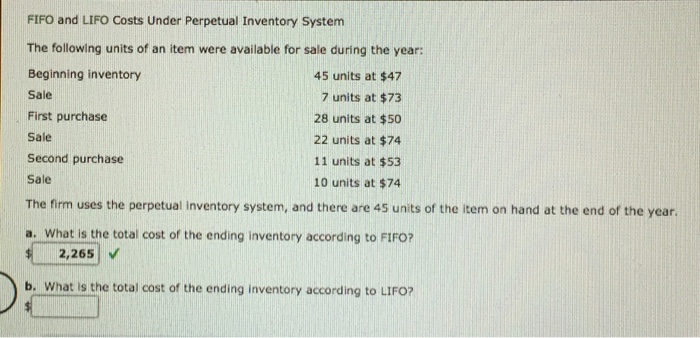

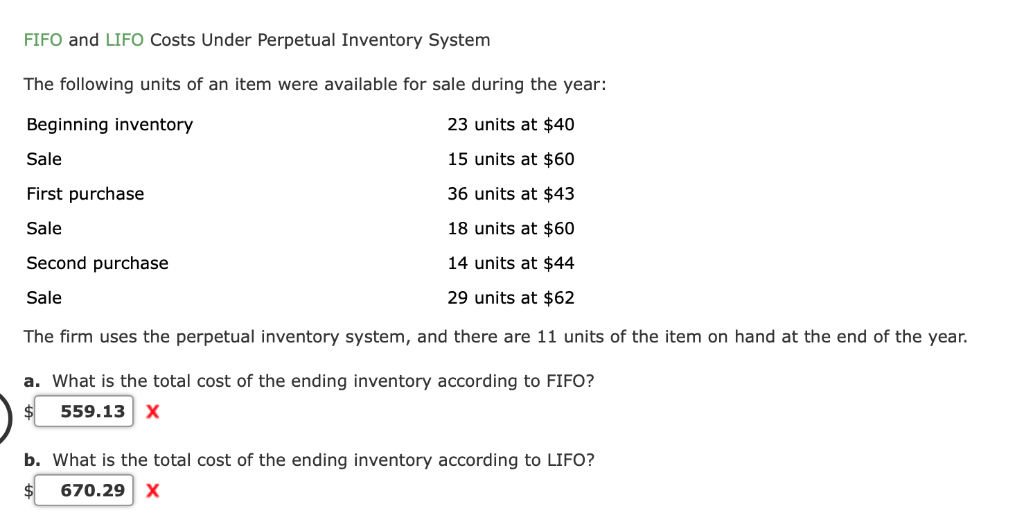

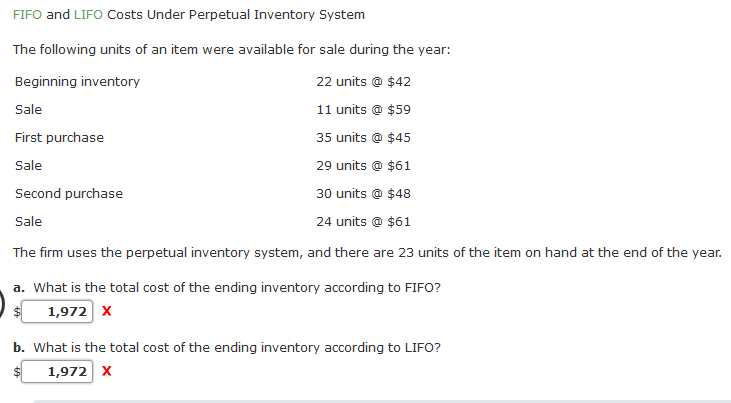

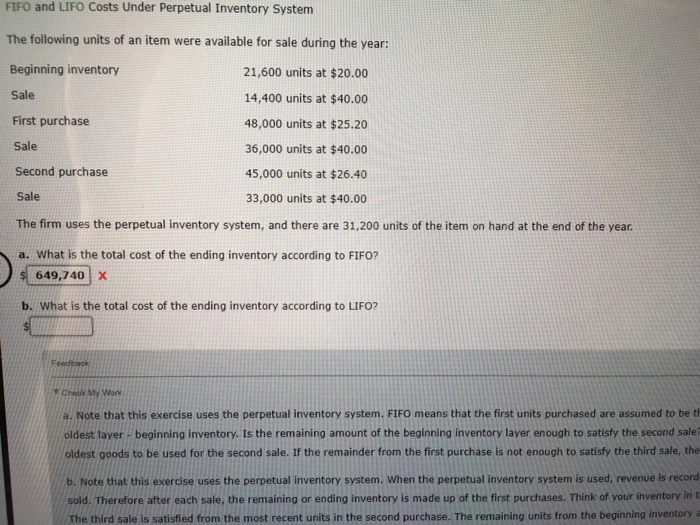

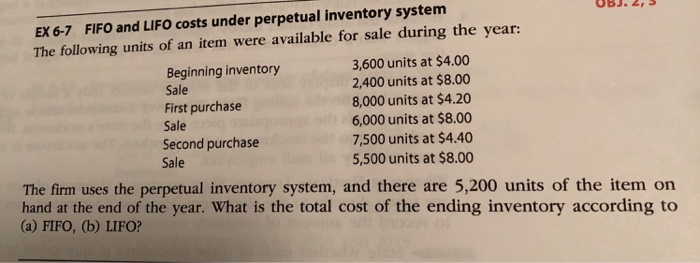

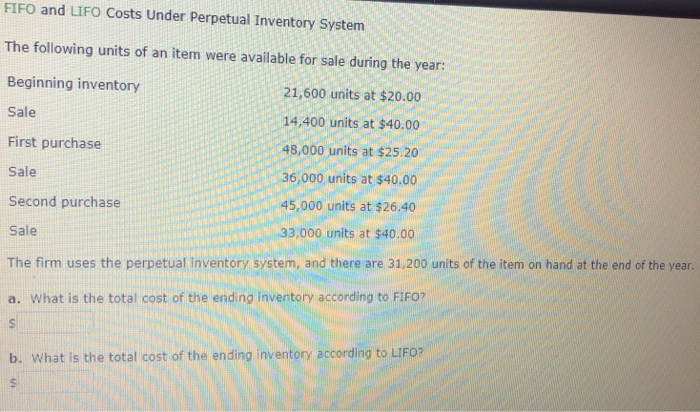

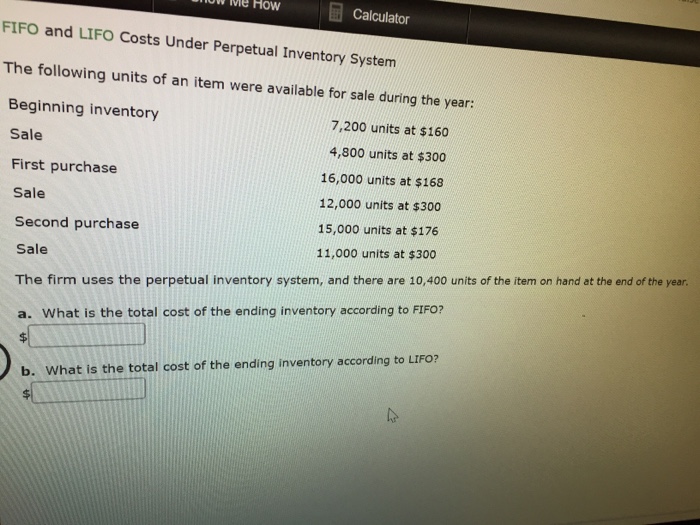

At the beginning of May the ledger of Boone showed Cash of 5000 and Owners Capital of 5000. FIFO and LIFO Costs Under Perpetual Inventory System The following units of an item were available for sale during the year. EX 7-7 FIFO and LIFO costs under perpetual inventory system The following units of an item were available for sale.

Herein is FIFO perpetual or periodic. Prepare a FIFO perpetual inventory card. FIFO and LIFO costs under perpetual inventory system The following units of an item were available for sale during the year.

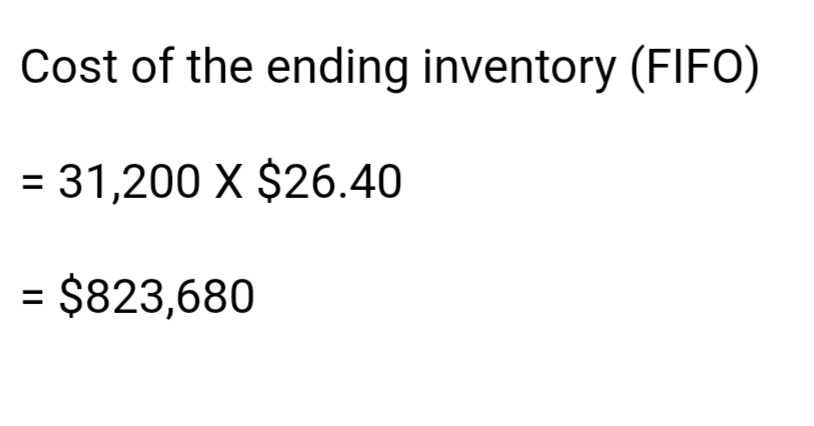

LIFO FIFO Lower of cost of market LIFO dollar. Cost of ending inventory under perpetual-fifo. Sale 33000 units at 4000.

May 1 Purchased merchandise on account from Adewales Wholesale Supply 4200. FIFO and LIFO under periodic and perpetual system rani. 89 will be credited to Inventory and 89 will be debited to Cost of Goods Sold.

FIFO or LIFO Inventory Methods. Is perpetual inventory system FIFO.

7200 see last row of balance column.

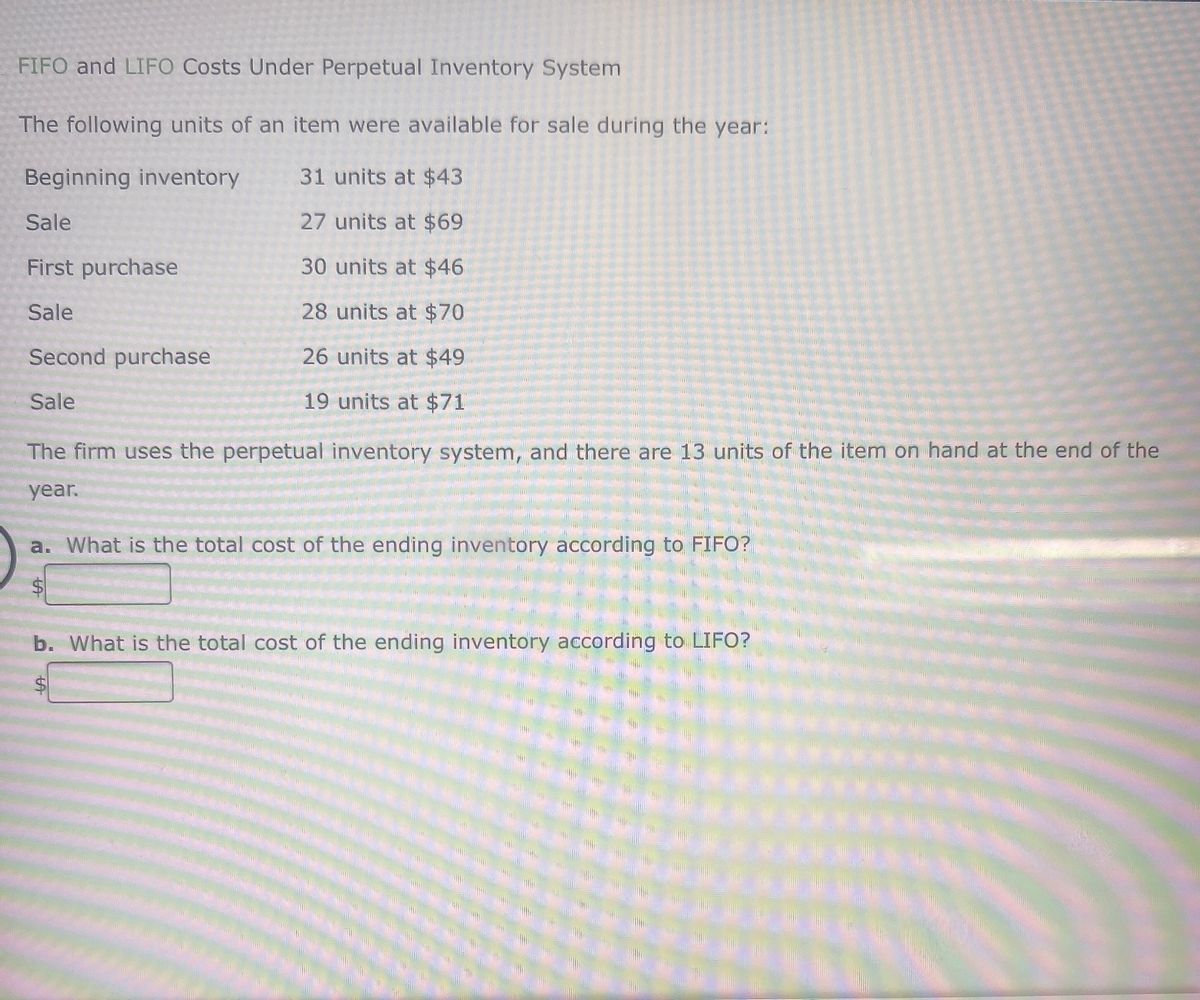

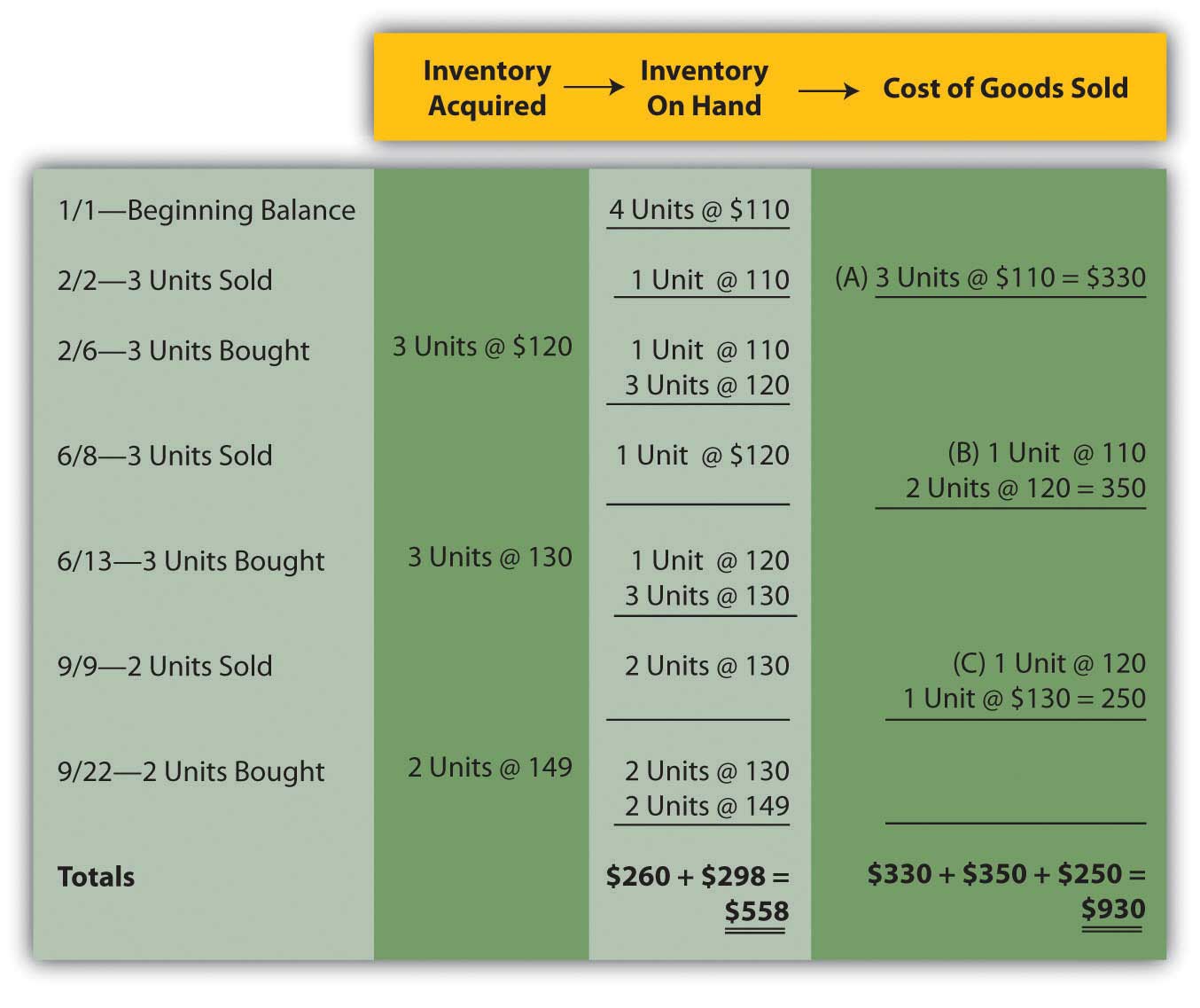

Understand that a cost flow assumption is only applied in computing the cost of ending inventory units in a periodic system but is used for each reclassification from inventory to cost of goods sold. Merge a cost flow assumption FIFO LIFO and averaging with a method of monitoring inventory periodic or perpetual to arrive at six different systems for determining reported inventory figures. FIFO and LIFO under periodic and perpetual system rani. Herein is FIFO perpetual or periodic. Prepare journal entries to record the above transactions under perpetual inventory system. Understand that a cost flow assumption is only applied in computing the cost of ending inventory units in a periodic system but is used for each reclassification from inventory to cost of goods sold. Sales-related purchase related transactions FIFO LIFO costs under perpetual system Periodic Inventory by methods see rest of problem for full. 240 84 324. EX 7-7 FIFO and LIFO costs under perpetual inventory system The following units of an item were available for sale.

At the beginning of May the ledger of Boone showed Cash of 5000 and Owners Capital of 5000. In a perpetual inventory system a business updates these accounts every time it buys and sells inventory which makes their balances readily available without an inventory count. Perpetual inventory system updates inventory accounts after each purchase or sale. If that was the only book sold during the year at the end of the year the Cost of Goods Sold account will have a balance of 89 and the cost in the Inventory account will be 351 85 87 89 90. Compute the cost of goods sold and the cost of inventory in hand at the end of the month of January 2012. Beginning inventory 37 units at 47 Sale 30 units at 73 First purchase 23 units at 49 Sale 11 units at 73 Second purchase 27 units at. Second purchase 45000 units at 2640.

Post a Comment for "Fifo And Lifo Costs Under Perpetual Inventory System"